Plan, Execute, and Succeed with Proven Strategies

Successful trading begins with a solid plan. Use reliable strategies, execute with discipline, and adapt to market conditions for consistent results.

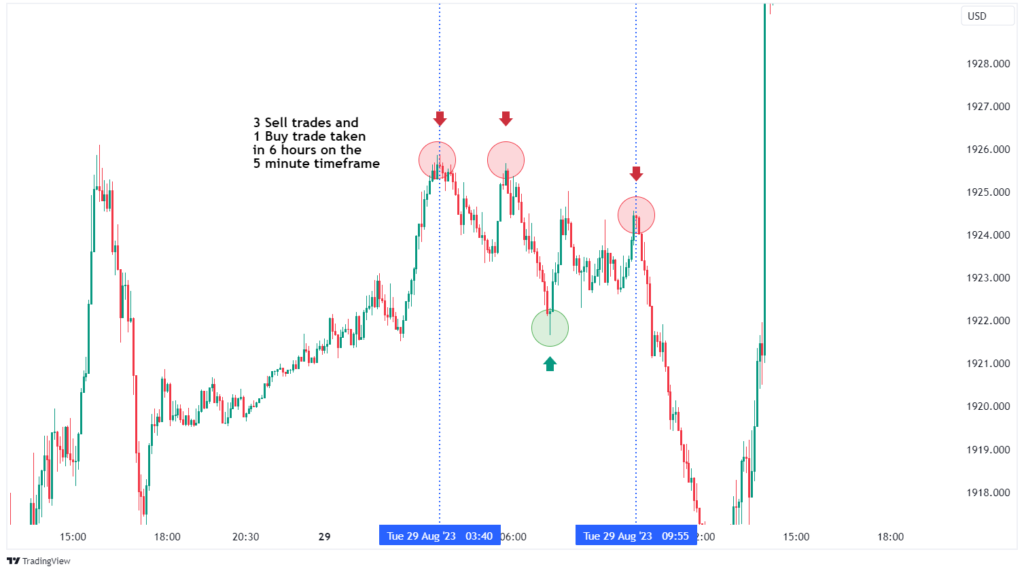

Timeframe: 1-minute to 5-minute charts

Objective: Make small profits from quick price changes throughout the day.

Scalping is a trading strategy where traders buy and sell quickly, usually within minutes, to take advantage of small price movements. They often make many trades each day, focusing on low costs and fast execution to maximize profits.

Risk:Requires constant attention, as holding trades for too long may lead to losses

- Moving Average

- Stochastic Oscillator

- Price Action Pattern

Timeframe: 15-Minute to 1-Hour Charts

Objective: Profit from intraday price movements without holding positions overnight.

Day traders buy and sell within the same day, steering clear of overnight risks. They focus on crucial market hours and aim to capitalize on short-term trends or events that drive price changes.

This strategy allows traders to react quickly to market fluctuations while managing risk effectively.

- RSI (Relative Strength Index)

- Trendlines

- Economic Calendar (for news events)

Timeframe: 4-hour to daily charts

Objective: Profit from medium-term price swings within broader trends.

Swing traders look for trends and hold positions for several days to weeks. Their goal is to buy at lower price points and sell at higher ones within a trend (or the opposite for shorting).

This strategy requires patience and allows for greater flexibility compared to day trading, as traders can take advantage of larger price movements over time.

Trend-following strategies operate on the belief that existing trends will persist.

Traders enter positions that align with the current trend and maintain them until they see signs of a reversal.

The guiding principle of this strategy is “The trend is your friend,” encouraging traders to capitalize on sustained price movements for potentially larger gains.

Timeframe: 1-hour to daily charts

Objective: Identify and trade in the direction of the prevailing trend.

Timeframe: Daily, Weekly, or Monthly charts

Objective: Hold trades for weeks or months to benefit from large price movements.

Position traders base their strategies on fundamental analysis, paying close attention to economic indicators and geopolitical events.

They hold their trades for extended periods, aiming to capitalize on significant market shifts and large price movements.

This long-term approach requires patience and a deep understanding of the factors that influence the market.

Risk Management Tips for All Strategies

Regardless of the strategy used, risk management plays a crucial role in ensuring long-term success.

Stop-Loss Orders

Set stop-loss orders to automatically close trades and limit potential losses.

Risk-Reward Ratio

Aim for a positive risk-reward ratio, such as 1:2, to ensure that potential profits outweigh potential losses.

Position Sizing

Adjust the size of your trades based on your risk tolerance, ensuring that no single trade can significantly impact your overall capital.

Avoid Overleveraging

Use leverage responsibly to reduce the risk of large losses during market fluctuations.