Finding the Right Forex Broker and Trading Platform

When trading in the forex market, choosing the right broker and platform makes a big difference, no matter your experience level. Every broker offers different features to suit various trading styles and goals.That’s why it’s important to carefully compare your options. Key things to look at include regulation, fees, and ease of use, as these will help you find a broker that fits your needs.

Look for Regulated Brokers

A good broker should be regulated by a well-known authority to ensure they follow financial rules and provide a safe trading experience. Some reliable regulators include the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. Choosing a regulated broker adds an extra layer of security, giving you peace of mind.

Understand Fees and Spreads

Fees can impact your profits, so it’s essential to understand how each broker charges. Some brokers charge commissions for every trade, while others make money through spreads (the gap between buying and selling prices).

If you trade often, small fees can add up, so look for brokers with competitive pricing—especially if you focus on specific currency pairs.

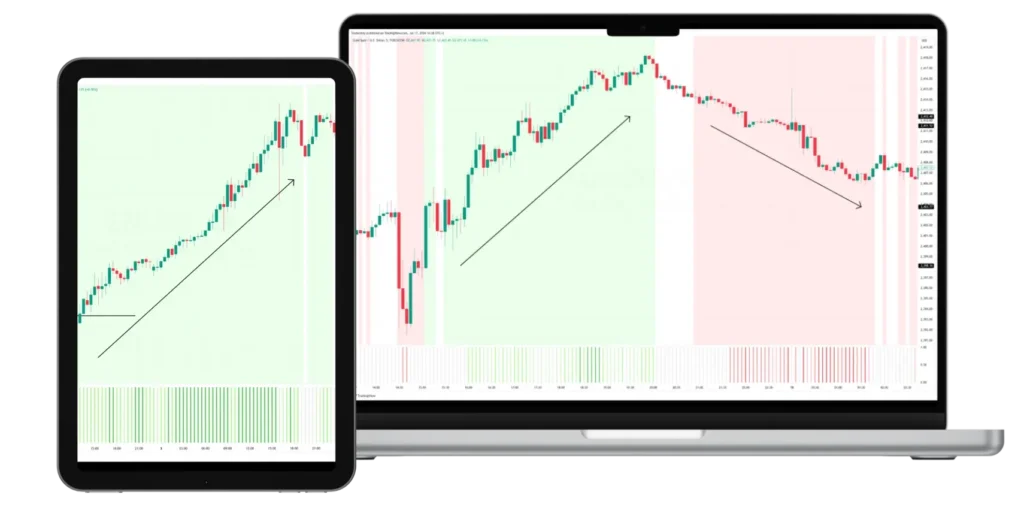

Choose a User-Friendly Platform

A good trading platform should be easy to use and offer helpful tools like charts and technical indicators to guide your decisions. The easier it is to navigate, the faster you can act on opportunities. Mobile apps are also a plus, letting you check your trades and manage positions wherever you are.

Final Thoughts

In the end, choosing the right broker and platform comes down to finding what works best for you. By focusing on regulation, fees, and user experience, you’ll be in a better position to trade with confidence and reach your financial goals.

Staying Updated with Forex News and Signals

The forex market changes constantly because of economic events, politics, and central bank actions. That’s why it’s important to stay informed. Timely news can affect your trading decisions and help you react quickly.

Key economic reports—like GDP, employment numbers, and inflation data—often cause major shifts in the market, so keeping up with the latest news can give you an edge.

How Trading Signals Can Help

In addition to news, many traders use signal providers to get insights and suggestions. These signals are based on technical or fundamental analysis, or sometimes a mix of both. The goal is to help you spot trading opportunities faster.

When choosing a signal provider, check their track record and see what other traders say in reviews. It’s also important to understand their methods—knowing how the signals are generated helps you decide if they align with your strategy.

Use Signals Wisely

While signals are helpful, don’t rely on them entirely. It’s always smart to do your own research and combine signals with other sources of information. By staying on top of the news and using signals as a guide, you’ll be better prepared to make smart trading decisions.

The forex market can be unpredictable, so learning and adapting is key. With the right information and tools, you can navigate the ups and downs and take advantage of new opportunities.