Evaluating Forex Brokers and Trading Platforms

1. Forex Brokers: Your Gateway to the Market

Forex brokers provide access to the currency market, but the experience can differ based on the broker you choose.

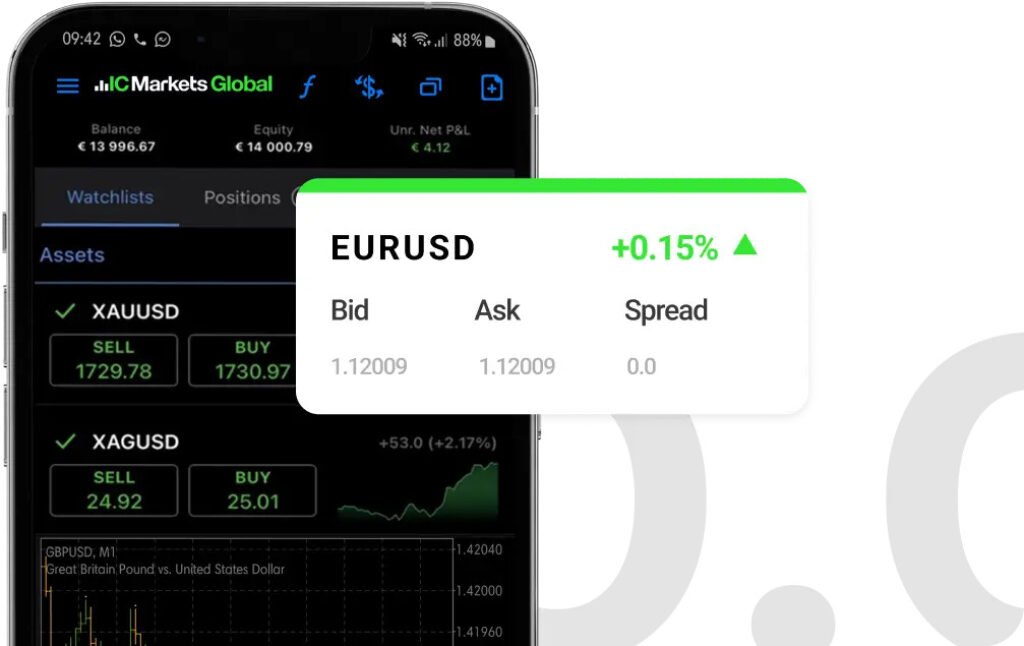

- Example 1: IC Markets (Australia)

- Why traders love it: IC Markets is an ECN broker known for tight spreads and fast execution, ideal for scalpers.

- Scenario: Imagine Sarah, a retail trader in London. She trades EUR/USD. IC Markets charges her a 0.1 pip spread, saving her money compared to other brokers with 1-2 pip spreads.

- Example 2: OANDA (USA)

- Why it stands out: Regulated in the US and offers low leverage (1:50) to comply with local rules.

- Scenario: Mike in New York uses OANDA to limit risk. Thanks to OANDA’s strict regulation and negative balance protection, he knows he won’t lose more than his deposit during volatile moves.

2. Trading Platforms: Tools for Smooth Trading

Your trading platform affects everything from speed to strategy execution.

- Example 1: MetaTrader 4 (MT4)

- Scenario: Emily, a day trader, uses MT4 because it’s easy to customize and supports Expert Advisors (EAs). She runs an automated strategy that buys when the RSI falls below 30 and sells when it rises above 70. MT4’s automation saves her hours of manual monitoring.

- Example 2: cTrader

- Scenario: Alex prefers cTrader because of its precise order execution and advanced charting tools. He places a stop-loss on every trade to manage his risks efficiently. During a fast market move, cTrader’s millisecond execution ensures he avoids slippage, protecting his profits.

- Mobile Trading: Platforms like TradingView allow Alex to check trades on his phone while commuting. With real-time charts and notifications, he can modify positions quickly if needed.

3. Prop Firms: Big Capital for Talented Traders

Prop firms allow traders to use large capital without risking their own money, but they must follow strict rules.

- Example 1: FTMO

- Scenario: John, a skilled trader, wants to manage more funds but doesn’t have enough capital. He takes FTMO’s challenge, hitting a 10% profit target in a month without breaching the drawdown limit (e.g., max 5% daily loss).

- Result: FTMO gives him a funded account of $100,000 with a 90% profit split. If John earns $5,000 in a month, he keeps $4,500 while FTMO takes $500.

- Example 2: MyForexFunds (MFF)

- Scenario: Priya takes the MFF challenge but misses the profit target by a small margin. However, MFF offers a free retry if she follows all the rules. On her second try, Priya passes and now manages a $50,000 account, earning 80% of the profits.

- Forex Brokers: IC Markets is great for tight spreads and scalping, while OANDA ensures safety with strict US regulations.

- Trading Platforms: MetaTrader 4 helps automate strategies, while cTrader offers lightning-fast execution and better control.

- Prop Firms: FTMO and MyForexFunds give talented traders the chance to manage large capital and earn high profit splits.

Real-Life Takeaway:

- Sarah benefits from low spreads on EUR/USD trades.

- Emily automates her strategy using MT4, saving time.

- John earns profits with FTMO’s $100,000 account and a 90% split without risking his own money.