Copy trading has become an increasingly popular way for both beginners and experienced investors to participate in financial markets with minimal effort. It offers a unique opportunity to copy the trading strategies of experts, giving you the chance to profit from their experience without spending years mastering market analysis. In this article, we’ll dive deep into how copy trading works, its advantages and risks, and whether it’s the right fit for you.

What is Copy Trading?

Copy trading allows investors to automatically mirror the trades of professional or experienced traders. When a trader buys or sells an asset, your account will replicate the same transaction in real-time. This system enables beginners to trade like seasoned investors without making decisions themselves.

It’s similar to outsourcing: Instead of doing everything on your own, you’re entrusting part of your trading to someone who has more experience or insight into the market. If the trader makes profits, so do you. But if they incur losses, your account reflects those as well.

Copy trading can be applied across various markets, including:

- Forex (foreign exchange)

- Cryptocurrency (Bitcoin, Ethereum, etc.)

- Stocks and ETFs

- Commodities (Gold, Oil)

How Does Copy Trading Work?

Here’s a step-by-step breakdown of the copy trading process

-

Join a Copy Trading Platform

To start, you need to register on a platform that offers copy trading. Some popular platforms include eToro, ZuluTrade, CopyTrader, and AvaTrade. These platforms connect you with thousands of traders you can follow.

-

Research and Select Traders

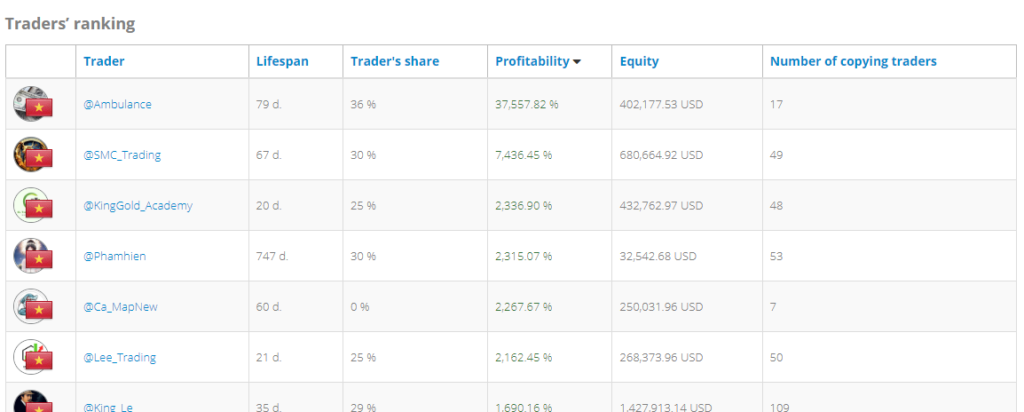

Platforms display a detailed profile of each trader, including:

- Performance history (profits/losses over time)

- Risk score (whether the trader takes high or low risks)

- Investment strategy (short-term trading, long-term investing, etc.)

- Assets traded (forex, crypto, stocks, etc.)

You can sort traders by performance, risk level, or strategy to find one that matches your goals.

-

Allocate Your Investment

Once you’ve selected a trader, you decide how much money you want to invest in copying their trades. Many platforms let you split your funds between multiple traders to spread your risk.

- Automatic Trade Replication

As the selected trader makes moves—like buying Bitcoin or selling EUR/USD—your account will automatically replicate those trades. If they make a profit, your account will reflect the same percentage gain. If they incur a loss, your investment takes the same hit. - Track and Adjust

Although copy trading is designed to be hands-off, it’s still important to monitor your portfolio occasionally. You can stop copying a trader or adjust your investments if needed.

A Real-Life Example of Copy Trading

Let’s say Sarah, a new investor, wants to explore forex trading but lacks the time and experience. She finds a trader named Alex on her platform who specializes in forex and has a good performance record. Sarah allocates $500 to copy Alex’s trades.

- If Alex buys EUR/USD at 1.05 and later sells it at 1.10, making a 5% profit, Sarah earns 5% too—her $500 grows to $525.

- But if Alex misjudges the market and incurs a 3% loss, Sarah’s investment will shrink to $485.

This example shows that while Sarah can benefit from Alex’s expertise, she’s also exposed to the same risks.

Who Can Benefit from Copy Trading?

Copy trading can be useful for a range of investors:

- Beginners: It allows newcomers to participate in the markets without needing in-depth knowledge or experience.

- Busy Investors: People who want to invest but lack time to monitor markets daily can benefit from this hands-off approach.

- Learners: Watching and copying experienced traders can teach you how markets work and help you understand different strategies.

- Diversifiers: Experienced investors can use copy trading to diversify their portfolios by following traders specializing in markets they don’t normally trade (e.g., forex or crypto).

Benefits of Copy Trading

- Saves Time

You don’t need to spend hours analyzing charts or news. The platform replicates trades automatically for you. - Learning Opportunity

Copy trading offers insight into how professional traders manage their portfolios. Over time, you can learn strategies and decision-making skills by watching their moves. - Diversification

Following multiple traders with different strategies can spread your risk. For example, you can copy one trader focused on stocks and another specializing in cryptocurrencies. - Accessibility

You don’t need years of experience to start copy trading. Many platforms are user-friendly and designed for beginners. - Passive Income Potential

If the traders you follow perform well, your account can grow without you actively managing it.

Risks of Copy Trading

- Market Risk

Even experienced traders can make mistakes. Copying their trades doesn’t eliminate the risk of losses. - Overconfidence

Some investors assume copy trading is “set-it-and-forget-it,” but it requires regular monitoring to ensure your chosen trader is still performing well. - Dependency on the Trader’s Strategy

You rely entirely on the trader’s decisions, which means you don’t control individual trades. If they take high risks, your account is exposed to those risks too. - Performance is Not Guaranteed

Past success doesn’t guarantee future profits. Traders who did well before may underperform in the future. - Fees and Spreads

Some platforms charge fees for copy trading, and trades may also incur spreads (the difference between buy and sell prices), which can impact your profits.

Tips for Successful Copy Trading

- Start Small

Begin with a modest investment to get comfortable with the process and minimize risk. - Research Traders Carefully

Take your time to study traders’ profiles, focusing on their performance, risk level, and strategy. Choose traders whose goals align with yours. - Diversify Your Portfolio

Spread your investment across multiple traders and markets. For example, follow one trader focused on stocks, another on crypto, and a third on forex. - Monitor Performance

Even though copy trading is automated, check your portfolio regularly. If a trader’s performance drops, you might need to stop copying them or adjust your strategy. - Understand the Risks

Remember that copy trading doesn’t eliminate risks. Be prepared for both gains and losses.

Is Copy Trading Right for You?

Copy trading can be an excellent option if you want to participate in the financial markets but don’t have the time or knowledge to trade on your own. It offers a passive way to invest, with the added benefit of learning from experienced traders. However, it’s not a guaranteed way to make money, and it requires careful selection of traders to follow.

If you prefer more control over your investments or enjoy researching markets yourself, you might find traditional trading more satisfying. But if you’re looking for a hands-off approach and are willing to accept some level of risk, copy trading could be a great addition to your investment strategy.

Conclusion

Copy trading makes investing more accessible by allowing you to follow the strategies of experienced traders. It offers a time-saving and educational way to participate in markets, but it’s essential to understand the risks involved. With proper research, diversification, and regular monitoring, copy trading can be a powerful tool for both beginners and seasoned investors.

As with any investment, success in copy trading depends on making informed decisions and staying aware of market trends. It’s not a shortcut to instant wealth, but with the right approach, it can be a useful way to grow your portfolio over time.