Forex trading offers exciting opportunities, but it also comes with risks. Without a good risk management strategy, even the best trades can lead to losses. In this article, we’ll walk you through how risk management works in forex trading, why it’s important, and simple strategies to help you trade smarter.

What is Risk Management in Forex?

Risk management in forex means controlling potential losses while maximizing profits. Since the forex market is highly volatile, prices can change quickly, so it’s essential to have strategies to protect your money.

The goal is not to avoid risks entirely, but to manage them effectively. It’s about being prepared for both wins and losses and ensuring that one bad trade doesn’t wipe out your account.

Why Risk Management is Important for Forex Traders

- Protects Your Capital: Even if you’re skilled, losses are inevitable. Risk management prevents major damage to your account.

- Prevents Emotional Trading: With rules in place, you’re less likely to make impulsive decisions out of fear or greed.

- Increases Long-term Success: Risk management keeps you in the game, giving you more opportunities to trade and learn.

Key Risk Management Strategies in Forex Trading

1. Set a Stop-Loss on Every Trade

A stop-loss is an automatic order that closes your trade if the market moves against you by a certain amount. This prevents small losses from becoming big ones.

Example: If you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your trade will automatically close if the price drops to 1.0950, limiting your loss to 50 pips.

2. Use Proper Position Sizing

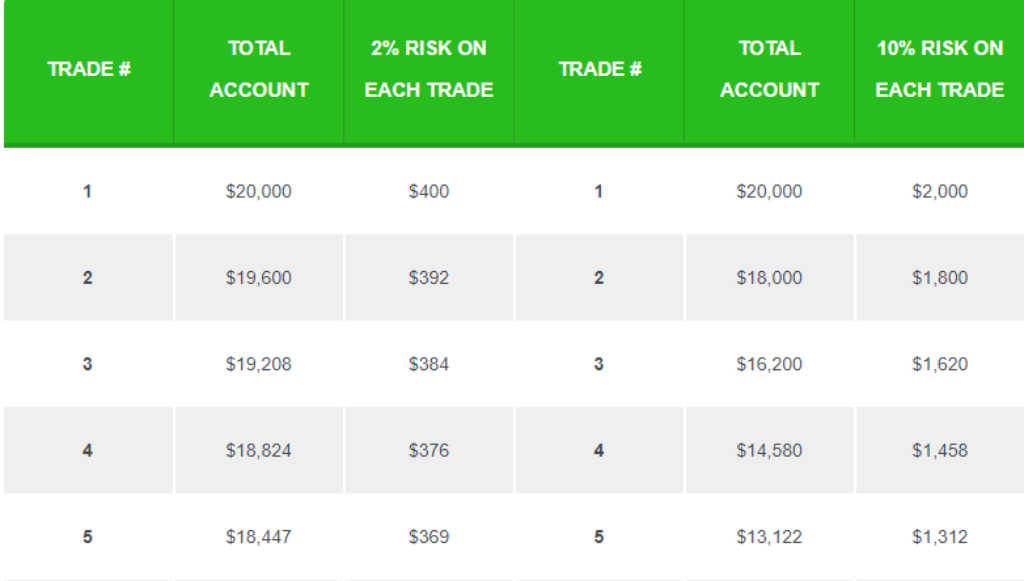

Position sizing means deciding how much of your capital you’ll risk on a trade. A common rule is to risk no more than 1-2% of your total capital on any single trade.

Example: If your account is $1,000, you should only risk $10 to $20 per trade. This way, even if a trade goes wrong, it won’t hurt your account too much.

3. Apply the Risk-to-Reward Ratio

The risk-to-reward ratio compares your potential profit to your potential loss. A ratio of 1:2 means you aim to make $2 for every $1 you risk.

This helps you ensure that, even with some losing trades, your profitable trades can keep you ahead.

4. Limit Leverage Use

Leverage allows you to trade with more money than you have in your account, but it also increases your risk.

Tip: Use leverage cautiously—too much can amplify your losses. For beginners, keeping leverage low (like 1:10) can be safer.

5. Don’t Overtrade

Overtrading happens when you take too many trades, often out of frustration or excitement. This increases your exposure to risk.

Stick to a trading plan, and only trade when you see a clear opportunity that aligns with your strategy.

6. Manage Your Emotions

Fear and greed are common in forex trading. Risk management helps you stay disciplined, so emotions don’t interfere with your decisions. If you feel stressed or frustrated, it’s often best to step away from the market for a while.

The Role of a Trading Plan in Risk Management

A trading plan is a personalized roadmap that outlines:

- Your trading strategy (what you trade and how)

- Entry and exit points (when to enter or exit trades)

- Risk management rules (position sizing, stop-loss levels, etc.)

Having a clear plan keeps you on track and prevents impulsive decisions. Review and update your plan regularly to adjust to changing market conditions.

Common Forex Risk Management Mistakes

- Skipping Stop-Loss Orders: Leaving trades open without a stop-loss can lead to major losses.

- Risking Too Much Per Trade: Placing large trades may feel exciting but can quickly drain your account.

- Ignoring Leverage Risks: Using too much leverage magnifies losses as well as profits.

- Trading Without a Plan: Random trades often lead to inconsistent results and frustration.

Example of a Risk Management Strategy in Action

Let’s say John has a $5,000 forex trading account. Here’s how he applies risk management:

- Trade Size: He risks 1% of his account per trade ($50).

- Stop-Loss: On a EUR/USD trade, he sets a stop-loss at 30 pips.

- Risk-to-Reward Ratio: He aims for a profit target of 60 pips (a 1:2 ratio).

- Leverage: John uses a 1:10 leverage to keep his exposure reasonable.

If the trade goes well, John earns $100. If it goes against him, he only loses $50. This approach allows John to keep trading sustainably.

How to Improve Your Risk Management Skills

- Start with a Demo Account: Practice risk management techniques without real money.

- Keep a Trading Journal: Track every trade, including wins, losses, and mistakes, to improve over time.

- Stay Informed: Markets are always changing. Keep learning about new strategies and tools to enhance your risk management.

- Be Patient: Risk management isn’t about making quick profits but building consistent, long-term success.

Risk management is essential for success in forex trading. It helps you protect your capital, avoid emotional trading, and stay in the game long enough to grow your skills and profits. By using stop-losses, managing your position size, and applying risk-to-reward ratios, you can trade more confidently and minimize potential losses.

Remember, no trading strategy is foolproof, and losses are part of the process. But with proper risk management, you can trade smarter, stay disciplined, and set yourself up for long-term success in the forex market.